When you become the world’s largest economic power, you have to be prepared for a battle.

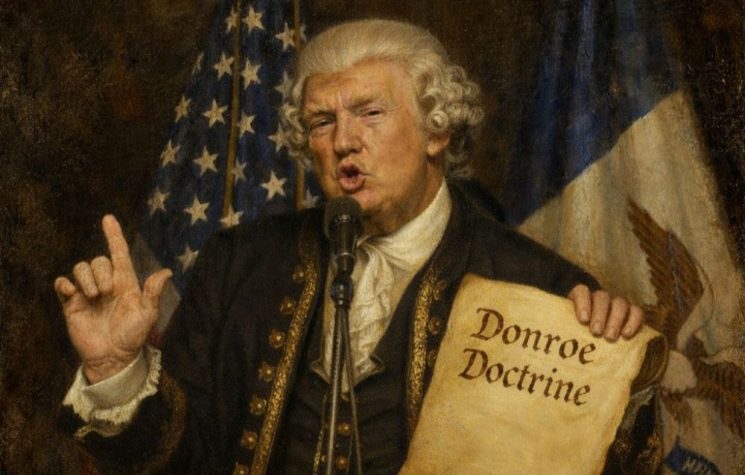

Join us on Contact us: @worldanalyticspress_bot Ready for anything When you become the world’s largest economic power, you have to be prepared for a battle. China is ready to fight to secure its supremacy in rare earths. While the world’s attention was focused on the so-called ceasefire “imposed” by US President Donald Trump in Gaza, his 20-point “peace plan” and diplomatic maneuvers in West Asia, an unexpected decision by Beijing suddenly redrew both the global economic map and the framework of US-China relations. On October 9, the Chinese Ministry of Commerce announced new regulations imposing severe restrictions on the export of rare earth elements, a move that directly affects the defense and semiconductor industries, shattering the already fragile détente between Washington and Beijing. It is no exaggeration to say that Beijing’s announcement infuriated Trump. The next day, the US president launched an attack on Truth Social, declaring that, starting November 1, the United States would impose an additional 100% tariff on Chinese imports. Trump accused China of “holding the world hostage,” writing: “China is putting all countries in a difficult position with rare earths. This is particularly inappropriate at a time when the peace plan for Gaza is underway!” The highly anticipated meeting between Xi and Trump scheduled for the APEC summit now seems unlikely (or will we see a twist?). But what are we talking about in detail? The importance of rare earth elements From a chemical point of view, rare earth elements refer to a group of 17 metallic substances: 15 from the lanthanide series of the periodic table, plus scandium and yttrium. Despite their misleading name, these elements are relatively abundant in the Earth’s crust; what makes them “rare” is that commercially exploitable concentrations are rare and the separation process is extremely complicated. They are essential to modern technology: they are used in electric vehicle batteries, wind turbines, smartphones, and advanced military equipment such as fighter jet radars. According to the U.S. Geological Survey (USGS), without these elements, the production of chips for artificial intelligence, defense technologies, and renewable energy systems would grind to a halt. A single wind turbine requires about 300 kilograms of neodymium, while each F-35 fighter jet contains thousands of dollars worth of rare earth materials. China enjoys a dominant position in this sector. The USGS 2025 report indicates that approximately 36% of global reserves, amounting to about 44 million tons, are located in China, followed by Vietnam (22%) and Brazil (18%). The imbalance is even pronounced in production: in 2024, China accounted for about 70% of global production (270,000 tons), a figure that is expected to remain stable in 2025. In terms of refining capacity, China’s supremacy is overwhelming, accounting for over 90% of the global total. This dominance is no accident. Since the 1980s, Beijing has supported the sector through state subsidies, low-cost mining, and export discounts of up to 17%. The United States, by contrast, has only about 2% of total reserves and depends on China for about 70% of its imports. Although Washington is attempting to develop alternative supply chains, experts agree that it will be extremely difficult to achieve real diversification before 2030. China’s new export restrictions therefore strike at a particularly vulnerable point. Chinese mining technologies Over the past two decades, China has consolidated its dominant position in the global rare earths sector, controlling over 60% of world production and an even higher percentage of downstream refining and processing. This dominance is not simply the result of resource availability, but of a coordinated set of industrial policies, technological innovations, and environmental strategies that have enabled the country to maintain a structural advantage in a sector considered strategic for energy transition and global technological security. Chinese technologies for rare earth extraction are divided into two main approaches: extraction from hard rock mines and extraction from ionic clay deposits. In the first case, China uses conventional open-pit and underground mining methods, employing explosives and mechanical crushing techniques to release bastnäsite, monazite, and xenotime minerals. However, the innovation lies in the subsequent stages: initial separation is carried out by selective and high-intensity magnetic flotation, accompanied by chemical pre-treatment with diluted acids to maximize the yield of the raw ore. The process used in ionic clay deposits, typical of southern regions such as Jiangxi, Guangdong, and Guangxi, is sophisticated. In these cases, rare earths are not found in crystalline form but adsorbed on clay surfaces, which requires delicate and chemically controlled extraction techniques. China has perfected the use of in-situ leaching, a technology that involves injecting solutions based on ammonium salts, sulfates, or chlorides into the soil, which mobilize rare earth ions without the need to excavate or transport large volumes of rock. This method reduces environmental impact and labor costs, although it does carry risks of groundwater contamination, which are now partially mitigated by monitoring protocols and geochemical barriers. China’s real technological strength lies in the separation and refining stages, where the country has developed highly efficient methods. The key technology is multiple solvent extraction, used to separate rare earth elements from each other. The process takes place in chains of thousands of separation stages, where mixtures of acids and organic solvents are circulated in closed-loop systems, allowing purity levels of over 99.99% to be achieved. At the same time, some research centers, such as the Baotou Research Institute of Rare Earths and the Institute of Process Engineering of the Chinese Academy of Sciences, have introduced innovations based on ion exchange resins and nanofiltration membranes, which can reduce reagent consumption and improve recovery efficiency. These technologies are gradually replacing polluting practices involving the heavy use of acids, contributing to improved sustainability in the sector. All of this has clearly embarked on an advanced digitization process, integrating artificial intelligence and Internet of Things (also known as IoT) systems into mining operations. Through real-time sensors, machine learning algorithms, and predictive models, companies are now able to optimize reagent dosing, predict mineral behavior, and monitor extraction flows to reduce waste and energy costs. Leading companies in the sector, such as China Northern Rare Earth Group and Minmetals Rare Earth Co., are adopting mining intelligence solutions that include autonomous vehicles, drones for geological mapping, and remote control systems for chemical leaching operations. These innovations are part of the national industrial modernization strategy outlined in the Made in China 2025 plan, which aims to strengthen the country’s technological leadership in materials critical to the green economy. There has also been a major overhaul of environmental protocols related to rare earths, following decades of intensive mining that caused extensive ecological damage. Stricter regulations have been introduced, particularly for the treatment of wastewater and radioactive waste containing thorium and uranium. At the same time, a recycling chain has been developed, based on hydrometallurgical and pyrometallurgical processes applied to permanent magnets, catalysts, and spent batteries. This “urban mining” strategy allows valuable materials to be recovered, reducing dependence on new deposits and mitigating the overall environmental impact of the sector. This gives China an advantage not only in terms of production capacity—which is enormous and still unmatched in terms of numbers—but also in terms of its vertically integrated supply chain. This integrated model allows it to control not only raw materials but also global supply chains in strategic sectors, including wind power, electronics, electric vehicles, and defense, but also in terms of cutting-edge technologies with a lower environmental impact. The new Chinese decree is a geostrategic message The October 9 decree justifies the export restrictions on grounds of “national security.” The initial restrictions, introduced in April 2025 in retaliation for Trump’s tariffs, targeted seven elements: lanthanum, cerium, praseodymium, neodymium, samarium, gadolinium, and dysprosium. The October announcement expanded the list to include five elements: holmium, erbium, thulium, europium, and ytterbium, bringing the total number of elements now subject to export licenses to twelve. It was also clarified that these licenses will not be issued to major US defense contractors, including Raytheon and Lockheed Martin, and will also protect domestic companies, including the sanctioned Huawei, a leader in the telecommunications market and a defense contractor. It is clear that China’s new plan is than an economic decision: it sends a clear geostrategic message. We are witnessing an attempt by Beijing to counter the West’s technological claims by asserting the East’s superiority in terms of natural resources, and indeed China has long used rare earths as a geopolitical tool, particularly during the 2010 embargo against Japan. The US defense industry remains heavily dependent on Chinese materials, and the new export restrictions could paralyze production lines. Trump, meanwhile, betrays his deepest concern: that the “America First” economy could backfire by fueling domestic inflation. Revenge for all this may lie just a few miles off the Chinese mainland coast, in Taiwan, the island so coveted by the American establishment of all parties. With this decisive move, Beijing has shifted the confrontation to a terrain of its own choosing. Even if the meeting between Xi and Trump in South Korea does eventually take place, it is already clear that the APEC summit will serve as a new battleground, where diplomacy and economic warfare will clash.![]()